The retail industry is undergoing an incredible transformation as emerging technologies, omnichannel shopping, as well as digital and social media, compel organizations to figure out how to operate more efficiently and better accommodate customers.

Leaders of companies in the retail industry understand the importance of the digital forces at work in the sector and are looking more closely at the inherent risks these digital forces present.

Every business comes with inherent risks, and running an e-commerce website or retail store isn’t any different. As more consumers shop online, e-commerce crimes are increasing and retailers are becoming more vulnerable.

Consequently, as organizations in the retail industry develop innovative ways to meet consumer demand, they also have to find better approaches for managing this inherent risk.

The following are just some of the inherent risks that affect companies in the retail industry:

Cybercrimes

Digital cybercriminals can target companies in the retail industry in several ways. For example, a hacker could launch a sophisticated phishing scam and convince your unwitting customers and/or employees to give up personal information, such as their credit card data.

A distributed denial of service attack can take down your company’s servers, preventing customers from purchasing products. Cyber thieves can also target brick-and-mortar retailers by hacking into their point-of-sale (POS) systems. Hackers can also infect a retailer’s systems with ransomware and malware.

Companies in the retail industry can manage these inherent risks by replacing legacy POS equipment and having a cybersecurity specialist audit their systems and software.

Reputation Risk Factors

Organizations in the retail industry are impacted by direct contact with consumers. The fact is that with the growth of social media, companies no longer control their own messaging.

Just one negative Facebook post, blog entry, tweet, or YouTube video can spell disaster for your company. Considering a large number of customer touchpoints, the chances that your brand’s reputation—and your revenue—will be negatively affected is pretty high.

To ensure your customers are happy, you should conduct consumer satisfaction surveys periodically to identify customer needs and expectations. You can also implement a customer relationship management system to deal with any complaints and reply to any questions. It’s also important to establish a policy to deal with social media so you can quickly respond to customers who leave negative comments about your company or products.

Not complying with laws and industry regulations

Companies that don’t adhere to government regulations as well as maintain the validity of their agreements and licenses, such as lease agreements, business licenses, advertising licenses, etc., may go out of business, suffer financial losses, or pay penalties. All of which could ruin a company’s reputation.

As such, you should ensure that your company:

- Adopts procedures to identify and comply with any changes in government and/or industry regulations.

- Implement processes to follow up on the terms of agreements and licenses.

- Establishes a time period to begin the action that’s necessary to renew agreements and licenses before they expire.

Supply chain risks

Over the last decade, supply chain risk management has emerged as a challenge for companies in the retail industry. Customers want to receive their products whenever and wherever they want them. So to meet customer demand and remain competitive, you have to transform your supply chain or risk losing out to your rivals.

Consequently, it’s imperative that you implement digitally enabled supply networks to enable cross-channel shopping with multiple delivery options and an easy return process. In addition, you have to assure customers that you have their items in stock and can deliver them when you say you will, as well as offer them a way to communicate with you in real-time.

Establishing a Digital Risk Framework

All your sensitive corporate data, automation, connectivity—all things digital—are inherently at risk because they are entry points for hackers. And the potential damage from just one cybersecurity incident is amplified because your digital systems are so embedded in your daily operations.

Companies in the retail industry that properly manage inherent risks become more competitive. Senior management should look to risk management to help them make better decisions about the company’s investments and its sustainability.

Digital risk management comprises numerous layers of risk defense, each linked via specific roles and responsibilities. However, it’s senior management who is responsible for setting the vision and assigning and coordinating these lines of defense. This helps them identify and correct redundancies in their organization’s risk management structure and prioritize how to control risks.

Generally, your business units should be the first line of defense in terms of dealing with digital inherent risk. They should work with your information technology department to incorporate risk-informed decision-making into your company’s daily operations.

In addition, they should figure out the level of risk they’re willing to accept, mitigate risks as appropriate, and escalate problems when the risks are more than the company is able to tolerate.

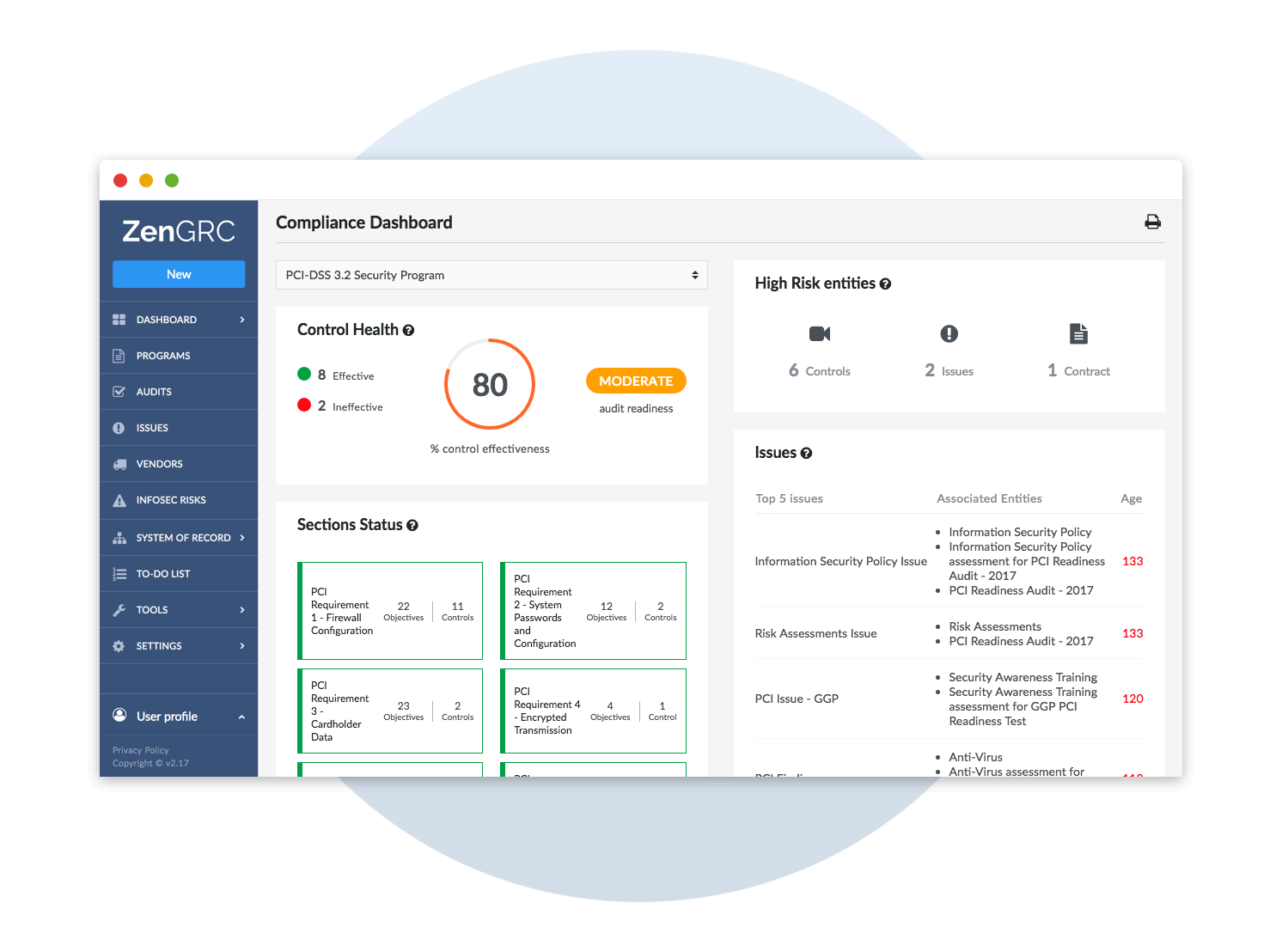

The second line of defense is the risk management function that establishes governance and oversight procedures, sets risk baselines, and implements risk management tools and processes.

The audit function is the third line of defense. Your internal auditors verify how effective your digital risk management process is and assures leadership and the board of directors that this process is working properly.

Additionally, your internal auditors let your company’s executives know if they have to make any improvements in the risk management process that can help the company to achieve its objectives.

Developing a digital risk management framework also helps your auditors evaluate the established controls you have in place to adequately address such risks.

Typically, an organization maintains multiple digital assets across a number of digital channels. The organization owns and controls some of these digital channels, including mobile apps, e-commerce websites, and IT infrastructure. Others are outside of the company’s direct control, such as what people say about the organization or its digital assets in the digital space.

Implementing a digital risk management framework can help companies in the retail industry expose potential risks. Doing this allows you to establish controls and repeatable processes as well as streamline your responses to these risks. A digital risk framework enables management to begin evaluating how well your company can sense and respond to digital risk.

This ongoing “sense and respond” approach to digital risk management crosses silos and affects all stakeholders. The building blocks for this method make up a comprehensive lifecycle process to help you do as much as you can to protect against these inherent risks—with the greatest competitive benefits.

There are a number of actions executives in companies in the retail industry can take to manage risk, including:

- Frame and benchmark the current risk management strategy. Then take an inventory of the supporting processes, policies, controls, and metrics, particularly as they apply to your digital assets and channels.

- Establish a digital governance structure as well as risk mitigation and response plans. Develop policies and procedures for the new digital age and implement risk management processes to support those policies and procedures.

- Launch an integrated risk management program, including assurance programs, frameworks, and activities, to business units and other relevant areas, such as your internal audit department and IT.

- Put business and digital risk management strategies in place. Test your risk processes and internal controls. For example, conduct escalation and response scenario testing. Also, implement reporting and performance management.

With a comprehensive risk framework, your company leaders can better manage risk. And by implementing a retail risk management strategy, you can nullify many threats before they happen. In addition, this risk framework allows executives to consider the level of risk the company is willing to take on while pursuing innovation and potentially profitable new ideas.

Increasingly, digital is becoming the center of the shopping experience. Therefore, it’s imperative that companies in the retail industry meet their customers’ growing demands while avoiding the inherent risks that may surface along the way.